Last week’s stock market strategy report said that the general market was surprisingly “oversold” and ready for an extension of the post-election rally. We certainly got that rally and more with the “Fear/Greed Sentiment Index” pushing into the “Extreme Greed” range for all 5 days. I would still expect a few days with readings over 90 before this rally has exhausted itself. But this is still no place to be going long and only the pros should consider heavy betting on the downside. If you’re inclined to trade, this may be a time to step aside and let the market zig-zag higher with non-confirmations or zig-zag lower into another short-term oversold condition. Either of these scenarios appears to be more than a week away. So stay on the sidelines and let the market set itself up for the next trading opportunity.

Last week’s stock market strategy report said that the general market was surprisingly “oversold” and ready for an extension of the post-election rally. We certainly got that rally and more with the “Fear/Greed Sentiment Index” pushing into the “Extreme Greed” range for all 5 days. I would still expect a few days with readings over 90 before this rally has exhausted itself. But this is still no place to be going long and only the pros should consider heavy betting on the downside. If you’re inclined to trade, this may be a time to step aside and let the market zig-zag higher with non-confirmations or zig-zag lower into another short-term oversold condition. Either of these scenarios appears to be more than a week away. So stay on the sidelines and let the market set itself up for the next trading opportunity.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR DECEMBER 4, 2016: The stock market has been correcting its move from the election lows over the past several days. With the majority of internal breadth indicators at “oversold” readings, a short-term rally should begin now. This final rally should mark the end of the big move from February’s low. Look for this rally to be lead by the oil stocks and unconfirmed by the leading technology stocks which typically signals the end of a major move.

STOCK MARKET STRATEGY FOR DECEMBER 4, 2016: The stock market has been correcting its move from the election lows over the past several days. With the majority of internal breadth indicators at “oversold” readings, a short-term rally should begin now. This final rally should mark the end of the big move from February’s low. Look for this rally to be lead by the oil stocks and unconfirmed by the leading technology stocks which typically signals the end of a major move.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Greed” after a short stint in the “Extreme Greed” territory. If we get a rally from right here, the new readings should mostly be in the “Extreme Greed” area and signal a time to get out of the market for the intermediate term. Expect a decline after this next rally to last two to three months and probably retract all of the “Trump Rally” and possibly more. But for now, look for one more short-term rally with several non-confirmations to finish this major move from the February lows.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stocks, tony robbins, trading, wall street

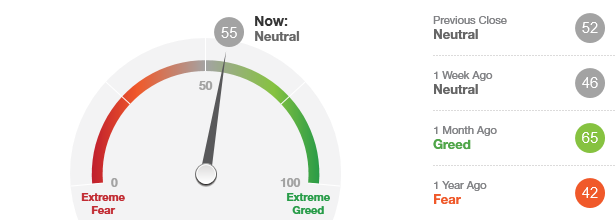

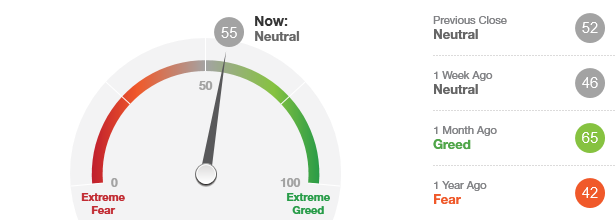

This indicator is labeled as being in the “Neutral” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

This indicator is labeled as being in the “Neutral” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

Categories: Fear & Greed Index Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR OCTOBER 3, 2016: The stock market has been climbing and dropping in the same price range for several weeks now. There isn’t a clear trend and the current market is neutral in terms of overbought vs. oversold. With the national election only a month away, I suspect that the markets will make a clearer trend before and then afterwards. So if we rally into the election, expect the opposite to occur after the election and vice versa. For now, keep your powder dry and wait for a better entry point.

STOCK MARKET STRATEGY FOR OCTOBER 3, 2016: The stock market has been climbing and dropping in the same price range for several weeks now. There isn’t a clear trend and the current market is neutral in terms of overbought vs. oversold. With the national election only a month away, I suspect that the markets will make a clearer trend before and then afterwards. So if we rally into the election, expect the opposite to occur after the election and vice versa. For now, keep your powder dry and wait for a better entry point.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators are neutral and trending down slightly. This would suggest that the market is likely to decline over the near term with the chance of reaching an oversold condition shortly. That would set up a rally to challenge and maybe exceed the all-time highs as we approach the elections. But right now isn’t an attractive time to buy unless we can get some more bearishness and lower prices.

Categories: Stock Market Strategy Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

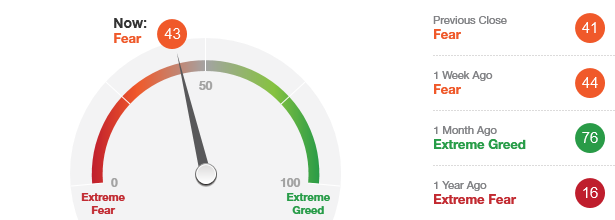

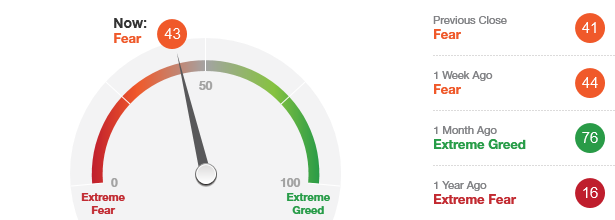

While this indicator is labeled as being in the “Fear” zone, the ideal buying opportunities have occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

While this indicator is labeled as being in the “Fear” zone, the ideal buying opportunities have occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

Categories: Fear & Greed Index Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR SEPTEMBER 18, 2016: The stock market has retreated and bounced around for the last few weeks. The internal indicators are near the lower range and could reach oversold readings if the market should fall in the coming days. Look for weakness early this week with the opportunity to buy near the end of the week for another run to new highs. If that scenario doesn’t set up that way, then step aside and let the market create a different kind of opportunity further down the road.

STOCK MARKET STRATEGY FOR SEPTEMBER 18, 2016: The stock market has retreated and bounced around for the last few weeks. The internal indicators are near the lower range and could reach oversold readings if the market should fall in the coming days. Look for weakness early this week with the opportunity to buy near the end of the week for another run to new highs. If that scenario doesn’t set up that way, then step aside and let the market create a different kind of opportunity further down the road.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators are neutral but within range of a bottom. While the readings have not been very severe to the downside, the length of time in this lower range suggests that a move up should be coming soon. It is based on that factor, that I’d be ready to move into action should we see weakness at the beginning of next week.

Categories: Stock Market Strategy Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

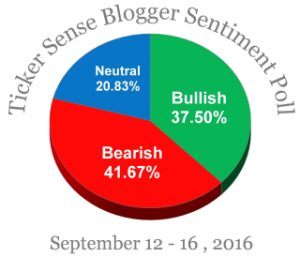

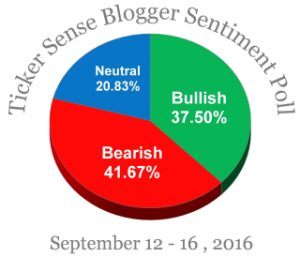

There has been an important shift in sentiment as the bears now outnumber the bulls 41.67% to 37.50%. This is one of the first prerequisites to forming an intermediate-term bottom. Now we need some more downside action to produce a higher degree of fear and for the internal breadth indicators to move into a deeply oversold area. That could happen as early as Friday, but more likely next week sometime. My guess is that the “Brexit Bottom” will hold and even serve as the most extreme lower boundary for any spike down in price.

There has been an important shift in sentiment as the bears now outnumber the bulls 41.67% to 37.50%. This is one of the first prerequisites to forming an intermediate-term bottom. Now we need some more downside action to produce a higher degree of fear and for the internal breadth indicators to move into a deeply oversold area. That could happen as early as Friday, but more likely next week sometime. My guess is that the “Brexit Bottom” will hold and even serve as the most extreme lower boundary for any spike down in price.

Categories: Blogger Sentiment Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR SEPTEMBER 5, 2016: The stock market reached a short-term low intraday on Wednesday. Since that time, the internal oscillators have been trending up. This has been a sideways correction with the Dow remaining in a 300-point trading range for 38 straight trading days. Another new closing high in the coming week is certainly possible. But overall, the market did not become oversold enough or create enough of a sentiment shift to fuel the market towards a big move upwards.

STOCK MARKET STRATEGY FOR SEPTEMBER 5, 2016: The stock market reached a short-term low intraday on Wednesday. Since that time, the internal oscillators have been trending up. This has been a sideways correction with the Dow remaining in a 300-point trading range for 38 straight trading days. Another new closing high in the coming week is certainly possible. But overall, the market did not become oversold enough or create enough of a sentiment shift to fuel the market towards a big move upwards.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators are all trending up after last Wednesday’s bottom. That gives the general market time to rally more and reach new high ground. But since the market did not become deeply oversold, I would be careful about being either long or short with any significant positions. A better risk/reward opportunity should present itself in the coming months which historically has been volatile. Keep your powder dry instead.

Categories: Stock Market Strategy, Uncategorized Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

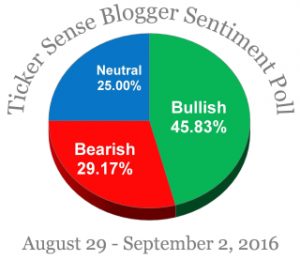

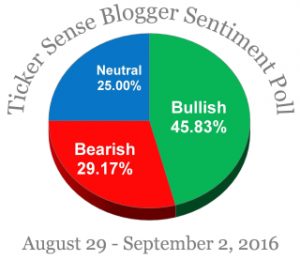

This sentiment indicator shows Bullish Sentiment at 45.83% and Non-Bullish Sentiment (Bearish + Neutral) at 54.17%. With this largely even spread between the bullish and non-bullish market stances among stock market bloggers, the general market can be deemed as “neutral” overall. That means that the market can go in either direction without bias. (Source: Ticker Sense)

This sentiment indicator shows Bullish Sentiment at 45.83% and Non-Bullish Sentiment (Bearish + Neutral) at 54.17%. With this largely even spread between the bullish and non-bullish market stances among stock market bloggers, the general market can be deemed as “neutral” overall. That means that the market can go in either direction without bias. (Source: Ticker Sense)

Categories: Blogger Sentiment Tags: insurance, investing, investments, life insurance, money, pensions, retirement, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR AUGUST 24, 2016: The stock market’s drop today has sent the breadth oscillators downwards towards a possible oversold condition by the beginning of next week. At this point, the market may begin to show more weakness and finally give us a clear pattern from which to trade from. So keep your powder dry and be ready to take positions in case an oversold scenario starts to take shape.

STOCK MARKET STRATEGY FOR AUGUST 24, 2016: The stock market’s drop today has sent the breadth oscillators downwards towards a possible oversold condition by the beginning of next week. At this point, the market may begin to show more weakness and finally give us a clear pattern from which to trade from. So keep your powder dry and be ready to take positions in case an oversold scenario starts to take shape.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators show that the market is finally trending downwards in unison. With today’s action, we have a pattern that may lead to a buying opportunity very shortly. This will probably be a “V-shaped” bottom without any kind of retest so be ready to take action on weakness in a few days. It may even be a spike down towards a key 200-day moving average which chartists will point to as being the pivot point. So be ready for a short-term trade on the long-side if the market sets up that way.

Categories: Stock Market Strategy Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

Last week’s stock market strategy report said that the general market was surprisingly “oversold” and ready for an extension of the post-election rally. We certainly got that rally and more with the “Fear/Greed Sentiment Index” pushing into the “Extreme Greed” range for all 5 days. I would still expect a few days with readings over 90 before this rally has exhausted itself. But this is still no place to be going long and only the pros should consider heavy betting on the downside. If you’re inclined to trade, this may be a time to step aside and let the market zig-zag higher with non-confirmations or zig-zag lower into another short-term oversold condition. Either of these scenarios appears to be more than a week away. So stay on the sidelines and let the market set itself up for the next trading opportunity.

Last week’s stock market strategy report said that the general market was surprisingly “oversold” and ready for an extension of the post-election rally. We certainly got that rally and more with the “Fear/Greed Sentiment Index” pushing into the “Extreme Greed” range for all 5 days. I would still expect a few days with readings over 90 before this rally has exhausted itself. But this is still no place to be going long and only the pros should consider heavy betting on the downside. If you’re inclined to trade, this may be a time to step aside and let the market zig-zag higher with non-confirmations or zig-zag lower into another short-term oversold condition. Either of these scenarios appears to be more than a week away. So stay on the sidelines and let the market set itself up for the next trading opportunity.