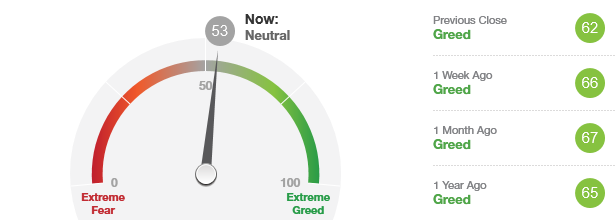

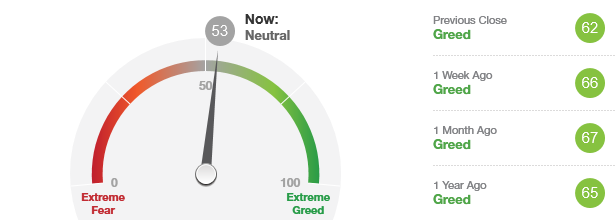

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has a current reading of 53 which is in the “Neutral” zone. This allows the market to go in either direction so it is neither a selling or a buying area.

This indicator has remained in the “Greed” area for most of December which is surprising when you consider the duration and extent of this rally. While recent buying opportunities have come when this indicator gets a reading of 25 or lower, the market may continue to rally without any resistance.

Today’s “Neutral” reading is a small move in the direction towards “Extreme Fear” and may be suggesting that an oversold/pessimistic bottom is coming in the first week or two of 2018. That would present a chance to get back onboard the market for another ride up to new highs.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR DECEMBER 3, 2017: Despite stock market’s historic run-up, it still may have more time to rally. Friday’s 300-point drop may have purged a lot of negativity and weak hands out of the market. The internal indicators are coming off of overbought readings and may be setting itself up for another rally after a brief drop into the traditional December 12-18 time slot. It’s more than likely that any correction of any significance will occur after the New Year.

STOCK MARKET STRATEGY FOR DECEMBER 3, 2017: Despite stock market’s historic run-up, it still may have more time to rally. Friday’s 300-point drop may have purged a lot of negativity and weak hands out of the market. The internal indicators are coming off of overbought readings and may be setting itself up for another rally after a brief drop into the traditional December 12-18 time slot. It’s more than likely that any correction of any significance will occur after the New Year.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Greed” after only one day being in the “Fear” territory. I’d still be looking to go long on any new oversold condition between December 12-18. Consider choppy action as a time to create such an oversold condition and a chance to once again ride up to new all-time highs.

Categories: Stock Market Strategy Tags: AAPL, AMZN, bonds, EFT, equities, invest, investing, investments, mutual funds, retirement, stock market, stocks, trading