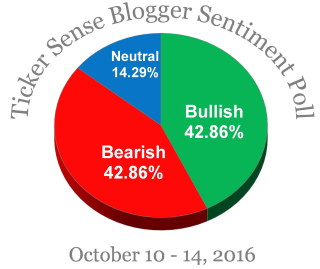

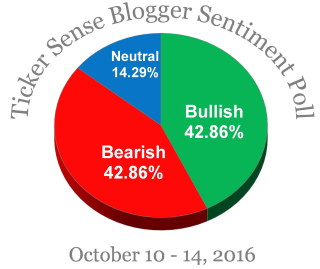

This indicator shows that the general stock market was completely neutral on Monday morning from a sentiment perspective. Both Bullish and Bearish blogger/market analysts weighed in at 42% each. This suggests that the market can go in either direction and that a top or bottom is weeks away. (Source: http://tickersense.typepad.com/ticker_sense/)

Categories: Blogger Sentiment Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

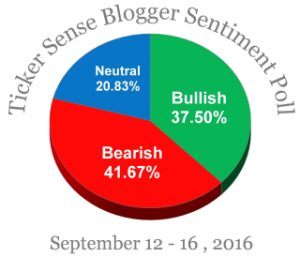

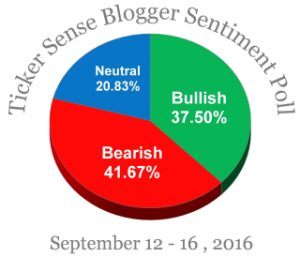

There has been an important shift in sentiment as the bears now outnumber the bulls 41.67% to 37.50%. This is one of the first prerequisites to forming an intermediate-term bottom. Now we need some more downside action to produce a higher degree of fear and for the internal breadth indicators to move into a deeply oversold area. That could happen as early as Friday, but more likely next week sometime. My guess is that the “Brexit Bottom” will hold and even serve as the most extreme lower boundary for any spike down in price.

There has been an important shift in sentiment as the bears now outnumber the bulls 41.67% to 37.50%. This is one of the first prerequisites to forming an intermediate-term bottom. Now we need some more downside action to produce a higher degree of fear and for the internal breadth indicators to move into a deeply oversold area. That could happen as early as Friday, but more likely next week sometime. My guess is that the “Brexit Bottom” will hold and even serve as the most extreme lower boundary for any spike down in price.

Categories: Blogger Sentiment Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

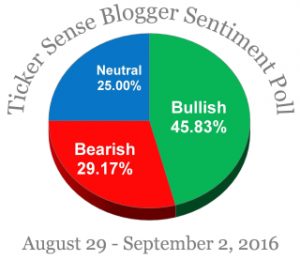

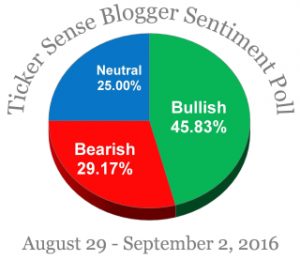

This sentiment indicator shows Bullish Sentiment at 45.83% and Non-Bullish Sentiment (Bearish + Neutral) at 54.17%. With this largely even spread between the bullish and non-bullish market stances among stock market bloggers, the general market can be deemed as “neutral” overall. That means that the market can go in either direction without bias. (Source: Ticker Sense)

This sentiment indicator shows Bullish Sentiment at 45.83% and Non-Bullish Sentiment (Bearish + Neutral) at 54.17%. With this largely even spread between the bullish and non-bullish market stances among stock market bloggers, the general market can be deemed as “neutral” overall. That means that the market can go in either direction without bias. (Source: Ticker Sense)

Categories: Blogger Sentiment Tags: insurance, investing, investments, life insurance, money, pensions, retirement, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

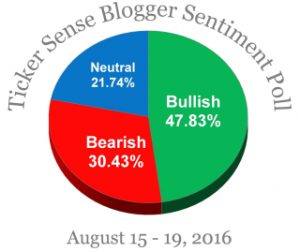

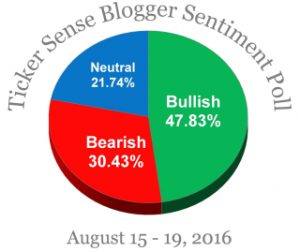

This sentiment indicator shows that the stock market is more bullish than bearish, but not as much as last week. In fact, the non-bullish elements of “neutral” and “bearish” add up to 52% of the survey. So based on the history of this indicator, the market is relatively neutral from a behavioral/sentiment perspective. This means that despite the long run-up since February 11, 2016, the market still has room to continue higher. (Source: Ticker Sense)

This sentiment indicator shows that the stock market is more bullish than bearish, but not as much as last week. In fact, the non-bullish elements of “neutral” and “bearish” add up to 52% of the survey. So based on the history of this indicator, the market is relatively neutral from a behavioral/sentiment perspective. This means that despite the long run-up since February 11, 2016, the market still has room to continue higher. (Source: Ticker Sense)

Categories: Blogger Sentiment Tags: insurance, investing, investments, life insurance, money, pensions, retirement, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

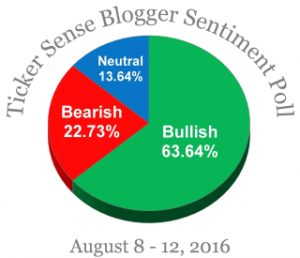

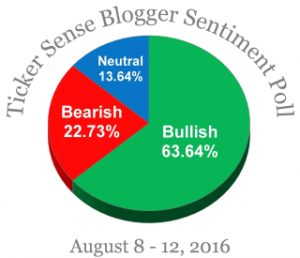

This unique sentiment indicator shows that the stock market is grossly over-loved at this time by blogger/stock market advisors. That means, an investor/trader should be very careful if they’re betting on the long side now. With market history as an indicator and the tendency of sentiment gauges being contrary indicators, the bullish party may be over soon. My experience with this indicator is that it tends to have about a one-to-two week lead time before the market reacts. In the present case, the market should top out in a week or two according to this indicator.

This unique sentiment indicator shows that the stock market is grossly over-loved at this time by blogger/stock market advisors. That means, an investor/trader should be very careful if they’re betting on the long side now. With market history as an indicator and the tendency of sentiment gauges being contrary indicators, the bullish party may be over soon. My experience with this indicator is that it tends to have about a one-to-two week lead time before the market reacts. In the present case, the market should top out in a week or two according to this indicator.

Categories: Blogger Sentiment Tags: insurance, investing, investments, life insurance, money, pensions, retirement, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street