STOCK MARKET STRATEGY FOR MARCH 25, 2018: The stock market is setting itself up for a climatic bottom over the short-term. Breadth indicators are in “oversold” territory with the chance of become even more oversold if the market should sell-off on Monday-Tuesday. While a market panic is difficult to buy into, it may still be the proper strategy for buying low and selling high. But the proper to tactic would be to buy in smaller increments spread over 3-5 days during periods of weakness. This takes discipline that few amateurs possess.

STOCK MARKET STRATEGY FOR MARCH 25, 2018: The stock market is setting itself up for a climatic bottom over the short-term. Breadth indicators are in “oversold” territory with the chance of become even more oversold if the market should sell-off on Monday-Tuesday. While a market panic is difficult to buy into, it may still be the proper strategy for buying low and selling high. But the proper to tactic would be to buy in smaller increments spread over 3-5 days during periods of weakness. This takes discipline that few amateurs possess.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 7 or “Extreme Fear.” With any weakness on Monday, this indicator will have the lowest reading in several years indicating a potential intermediate term bottom. To spread the risk, a wise trader should buy a combination of diversified broad-based ETFs and strong Blue-Chip dividend-paying stocks (example: Exxon, Microsoft, Apple, Wells Fargo). The first step would be to buy on extreme weakness in small pilot positions and add gradually. If a market panic should occur, it may take a few days for the market to stabilize or bounce. And then there is the possibility of a final wave down which a trader must be anticipate when conditions become so extreme as they are now.

Categories: Uncategorized Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

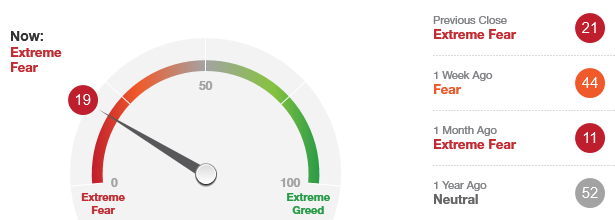

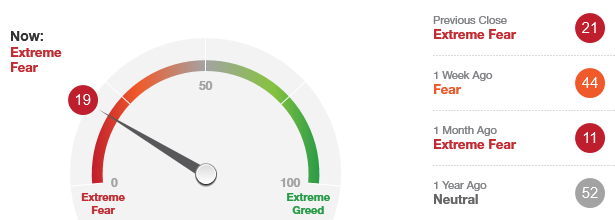

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has a current reading of 19 which is in the “Extreme Fear” zone. This suggests that the market is in a buying range and not a selling range. Tactically, this means that you should either buy or hold depending on your situation.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has a current reading of 19 which is in the “Extreme Fear” zone. This suggests that the market is in a buying range and not a selling range. Tactically, this means that you should either buy or hold depending on your situation.

This indicator ventured out into the “Fear” area about a week ago, but has returned back into the “Extreme Greed” zone once again. My guess is that this indicator will not stay in the “Extreme Greed” area very long since it has already spent an abnormally long period of time in it last month.

I would look to buy weakness especially if we should receive oversold readings in breadth indicators, moves toward major indexes 200-day moving averages or retests of previous correction lows. While it is hard to say how much higher the general market can go up from here, the important thing to keep in mind is that this market has been correcting for a long enough time to support a healthy multi-month rally.

Categories: Fear & Greed Index Tags: AAPL, AMZN, bonds, EFT, equities, invest, investing, investments, mutual funds, retirement, stock market, stocks, tony robbins, trading, wealth mastery

STOCK MARKET STRATEGY FOR MARCH 10, 2018: The stock market is currently “overbought” in most of the internal indicators. Therefore, the market can hit a short-term top at any time. This has been a very tricky market to trade precisely, since the swings have been so punishing over the short-term when being too early with large bets. The market still has room to rally to the upside. As far as taking new long positions, the time for that was either last week or early February. Now is a time to watch and wait for the next “oversold” set-up.

STOCK MARKET STRATEGY FOR MARCH 10, 2018: The stock market is currently “overbought” in most of the internal indicators. Therefore, the market can hit a short-term top at any time. This has been a very tricky market to trade precisely, since the swings have been so punishing over the short-term when being too early with large bets. The market still has room to rally to the upside. As far as taking new long positions, the time for that was either last week or early February. Now is a time to watch and wait for the next “oversold” set-up.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 44 or “Fear.” This is the first move out of the “Extreme Fear” area in several weeks. As far as sentiment goes, we had our chance over the past month to take long positions on weakness. The thing to do now, is wait for a short-term oversold condition in two the McClellan Oscillators (the most reliable short-term indicators) in order to take new positions for another trip into new high territory.

Categories: Stock Market Strategy Tags: AAPL, AMZN, bonds, EFT, equities, invest, investing, investments, mutual funds, retirement, stock market, stocks, tony robbins, trading, wealth mastery

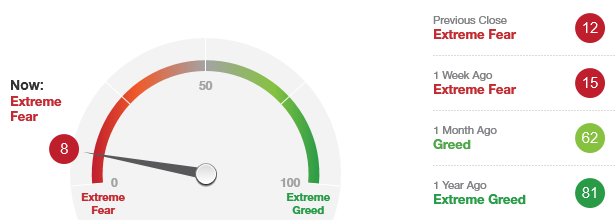

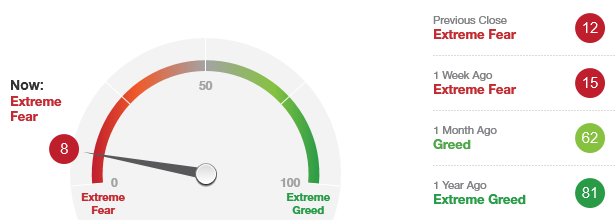

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has a current reading of 8 which is well into the “Extreme Fear” zone. This suggests that the market is in a buying range and not a selling range. Tactically, this means that you should either buy or hold depending on your situation.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has a current reading of 8 which is well into the “Extreme Fear” zone. This suggests that the market is in a buying range and not a selling range. Tactically, this means that you should either buy or hold depending on your situation.

This indicator has remained in the “Extreme Fear” area for several weeks now. This is very abnormal and suggests that we have corrected long enough in terms of time. But the charts of the major indexes don’t appear to have declined enough in terms of price.

Today’s “Extreme Fear” reading means that it’s time to start taking pilot positions if you’re under-invested in preparation for a rally to challenge the old highs. A bottom may likely appear on either Friday or Monday but actually picking that bottom will be hard to do as always. You will have sweaty palms from the fear of taking a risk here, but it’s about time for the market to get out of the “Extreme Fear” zone. It’s been here too long.

Note: This reading of 8 is the lowest of this current down cycle and may mark the bottom of this correction.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR MARCH 25, 2018: The stock market is setting itself up for a climatic bottom over the short-term. Breadth indicators are in “oversold” territory with the chance of become even more oversold if the market should sell-off on Monday-Tuesday. While a market panic is difficult to buy into, it may still be the proper strategy for buying low and selling high. But the proper to tactic would be to buy in smaller increments spread over 3-5 days during periods of weakness. This takes discipline that few amateurs possess.

STOCK MARKET STRATEGY FOR MARCH 25, 2018: The stock market is setting itself up for a climatic bottom over the short-term. Breadth indicators are in “oversold” territory with the chance of become even more oversold if the market should sell-off on Monday-Tuesday. While a market panic is difficult to buy into, it may still be the proper strategy for buying low and selling high. But the proper to tactic would be to buy in smaller increments spread over 3-5 days during periods of weakness. This takes discipline that few amateurs possess.