STOCK MARKET STRATEGY FOR AUGUST 30, 2015: The stock market has established a panic intraday low which will most likely not be violated in the intermediate term. However, a retest of the lows may produce a new closing low for the DJIA. Such a move would create the ideal environment to establish new positions for a run towards new all-time highs. But first, we need to work off the present rally, chew up time, and start the decline down below Tuesday’s closing low.

STOCK MARKET STRATEGY FOR AUGUST 30, 2015: The stock market has established a panic intraday low which will most likely not be violated in the intermediate term. However, a retest of the lows may produce a new closing low for the DJIA. Such a move would create the ideal environment to establish new positions for a run towards new all-time highs. But first, we need to work off the present rally, chew up time, and start the decline down below Tuesday’s closing low.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators show that there is still more room to the upside. But overall, the set-up is not ideal for taking on new long positions (or short positions for that manner). This is one of those times where the majority of investors and traders should step aside and let things settle down to more reasonable/tolerable daily swings.

Categories: Stock Market Strategy Tags: ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

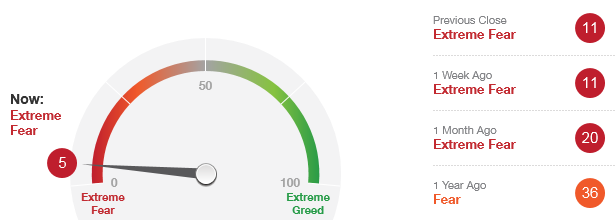

STOCK MARKET STRATEGY FOR AUGUST 23, 2015: The Fear & Greed Index has a current reading of 5 indicating “Extreme Fear.” This means that in terms of sentiment, we are in the buy zone now. If we don’t get government manipulation over the weekend, it is possible that we have a panic intraday low on either Monday or Tuesday. This might lead to a short-term bounce of several hundred Dow points. And while the past declines have resulted in V-shaped bottoms, this correction may be the one that requires a retest of the lows in order to begin a sustainable rally.

STOCK MARKET STRATEGY FOR AUGUST 23, 2015: The Fear & Greed Index has a current reading of 5 indicating “Extreme Fear.” This means that in terms of sentiment, we are in the buy zone now. If we don’t get government manipulation over the weekend, it is possible that we have a panic intraday low on either Monday or Tuesday. This might lead to a short-term bounce of several hundred Dow points. And while the past declines have resulted in V-shaped bottoms, this correction may be the one that requires a retest of the lows in order to begin a sustainable rally.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: While the market has gone down a lot in terms of price and sentiment, but it has not gone down long enough in duration. That means that bounces can be played nimbly over the short term, but a safer longer term bottom is probably weeks away. You may want to play the bounce which could come on Monday or Tuesday, but it might be wiser to wait at least for the retest of Friday’s low.

Categories: Stock Market Strategy Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

Categories: Fear & Greed Index Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

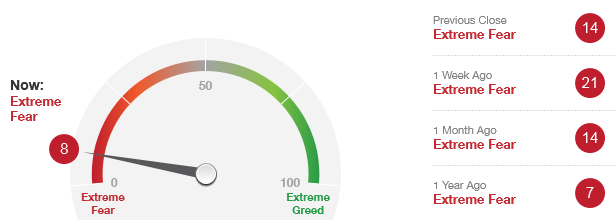

STOCK MARKET STRATEGY FOR AUGUST 16, 2015: The stock market remains in a tight trading range. With all of the internal indicators in neutral positions, the market can go in either direction. Despite the “Extreme Fear” reading of the Fear & Greed Index, it still has more room to the downside. All things considered, the market does not appear to be ready to rally right now. But a move to the downside here, could finally trigger the negative sentiment needed to make an intermediate-term bottom.

STOCK MARKET STRATEGY FOR AUGUST 16, 2015: The stock market remains in a tight trading range. With all of the internal indicators in neutral positions, the market can go in either direction. Despite the “Extreme Fear” reading of the Fear & Greed Index, it still has more room to the downside. All things considered, the market does not appear to be ready to rally right now. But a move to the downside here, could finally trigger the negative sentiment needed to make an intermediate-term bottom.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: This may be a good time to lighten up on your positions in anticipation for a panic low in the near term. With the prospects of a hike in interest rates as early as September, the level of fear has created the sentiment for a possible panic low and trading bottom. But first, we need a washout to the downside. This is something that you may want to step aside and avoid right now. My advice is to keep your powder dry and anticipate a better buying opportunity after a sharp drop.

Categories: Stock Market Strategy Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

Categories: Fear & Greed Index Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

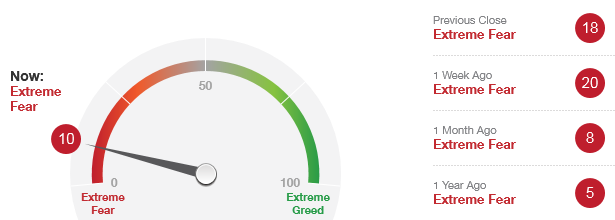

STOCK MARKET STRATEGY FOR AUGUST 8, 2015: The stock market has now gone down for 7 days straight. With the Fear & Greed Index showing an “Extreme Fear” reading of 10, we are now in the vicinity of a profitable trading low. But with most of the internal indicators that I follow still in neutral territory, I’d push out this next trading low to around August 13th. A good clue of the bottom would be when the majority of the indicators (3 or more) show oversold readings.

STOCK MARKET STRATEGY FOR AUGUST 8, 2015: The stock market has now gone down for 7 days straight. With the Fear & Greed Index showing an “Extreme Fear” reading of 10, we are now in the vicinity of a profitable trading low. But with most of the internal indicators that I follow still in neutral territory, I’d push out this next trading low to around August 13th. A good clue of the bottom would be when the majority of the indicators (3 or more) show oversold readings.

Key underlying short-term market indicators show the following:

***********

ADVICE TO TRADERS AND INVESTORS: Be looking to buy on weakness in the coming trading sessions especially if we get oversold readings. The safest buy bets will be in the major broad-based Exchange-Traded Funds (DIA, SPY, QQQ) as there is no telling which sectors will perform best. You can also take small positions in the leveraged ETFs (DDM, QLD, SSO) for a quick ride up to challenge the old highs once again. But beware because the next closing Dow Jones Industrial Average new high may be the last one for a long time to come. This is especially true if the next rally is lead by the oils.

Categories: Stock Market Strategy Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR AUGUST 2, 2015: The stock market may have reached an important intermediate closing low on Monday July 28th. Since that date, it has advanced to an area of resistance that we find ourselves at this time. With the internal indicators in neutral position, the general market has the probability of going in either direction. But the likelihood is that the lows have already been seen and that dips should be bought now for a ride back up to the old closing highs.

STOCK MARKET STRATEGY FOR AUGUST 2, 2015: The stock market may have reached an important intermediate closing low on Monday July 28th. Since that date, it has advanced to an area of resistance that we find ourselves at this time. With the internal indicators in neutral position, the general market has the probability of going in either direction. But the likelihood is that the lows have already been seen and that dips should be bought now for a ride back up to the old closing highs.

Key underlying short-term market indicators show the following:

***********

ADVICE TO TRADERS AND INVESTORS: Be looking to buy on weakness in the coming 5 to 7 trading sessions. The safest buy bets will be in the major broad-based Exchange-Traded Funds (DIA, SPY, QQQ) as there is no telling which sectors will perform best. You can also take small positions in the leveraged ETFs (DDM, QLD, SSO) for a quick ride up to challenge the old highs once again.

Categories: Stock Market Strategy Tags: AAPL, ETF, invest, investing, investing tips, investments, money, QQQ, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR AUGUST 30, 2015: The stock market has established a panic intraday low which will most likely not be violated in the intermediate term. However, a retest of the lows may produce a new closing low for the DJIA. Such a move would create the ideal environment to establish new positions for a run towards new all-time highs. But first, we need to work off the present rally, chew up time, and start the decline down below Tuesday’s closing low.

STOCK MARKET STRATEGY FOR AUGUST 30, 2015: The stock market has established a panic intraday low which will most likely not be violated in the intermediate term. However, a retest of the lows may produce a new closing low for the DJIA. Such a move would create the ideal environment to establish new positions for a run towards new all-time highs. But first, we need to work off the present rally, chew up time, and start the decline down below Tuesday’s closing low.