STOCK MARKET STRATEGY FOR OCTOBER 29, 2016: From a breadth perspective, the stock market is in an oversold condition right now. But it is days to a week or so away from reaching a similar level on a sentiment basis. With the big news on the political front Friday, that sentiment could change quickly to get in line with the breadth indicators causing a bottom to form around Election Day November 7-9. Be ready to buy long on a panic low forming around that time.

STOCK MARKET STRATEGY FOR OCTOBER 29, 2016: From a breadth perspective, the stock market is in an oversold condition right now. But it is days to a week or so away from reaching a similar level on a sentiment basis. With the big news on the political front Friday, that sentiment could change quickly to get in line with the breadth indicators causing a bottom to form around Election Day November 7-9. Be ready to buy long on a panic low forming around that time.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The sentiment indicators such as the Fear/Greed Index and the Blogger Sentiment Poll are in neutral positions. Before a sustained move in either direction, we need these indicators to go to an extreme. But the internal breadth indicators are now at oversold readings. This means that the breadth of the market has been extremely negative and is one of the key prerequisites to a bottom formation. That bottom looks like it is forming just in time for Election Day. Caution: It will be tricky and hard to catch at the exact bottom. Being a day or two early or late could cost you lots of money so be nimble and ready to buy incrementally into the panic. It will most likely be a V-shaped bottom.

Categories: Stock Market Strategy Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR OCTOBER 22, 2016: The stock market is in a neutral trading range as it sets itself up for a possible big move around Election Day. The internal breadth indicators are trending up suggesting that a minor short-term top could occur during the coming week. Then we could have a final drop into a low about November 7-9. Now would be a good time to get yourself ready to participate in a year-end rally of significance. But first, beware of news that will trick the public into selling right at the turning point…alas the Brexit vote.

STOCK MARKET STRATEGY FOR OCTOBER 22, 2016: The stock market is in a neutral trading range as it sets itself up for a possible big move around Election Day. The internal breadth indicators are trending up suggesting that a minor short-term top could occur during the coming week. Then we could have a final drop into a low about November 7-9. Now would be a good time to get yourself ready to participate in a year-end rally of significance. But first, beware of news that will trick the public into selling right at the turning point…alas the Brexit vote.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal breadth and sentiment indicators such as the Fear/Greed Index and the Blogger Sentiment Poll are in neutral positions. Before a sustained move in either direction, we need these indicators to go to an extreme. That takes time which means that nothing of significance will occur in the general market for a few weeks.

Categories: Stock Market Strategy Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

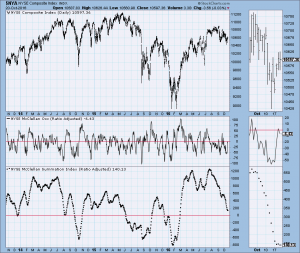

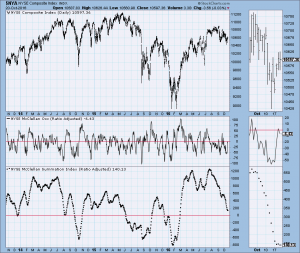

Looking at the bottom chart of the Summation Index, I’d be very careful about trying to catch the bottom of this move. It looks like a giant head-and-shoulder top to me. That means a lot more time devoted to the downside and a reading of -400 minimum. After it crosses the -400 reading, you have about a 1-2 weeks lead-time before the final bottom is reached. And as we all know, the exact bottom is usually very tricky to catch….better to scale-in on the final leg down.

Looking at the bottom chart of the Summation Index, I’d be very careful about trying to catch the bottom of this move. It looks like a giant head-and-shoulder top to me. That means a lot more time devoted to the downside and a reading of -400 minimum. After it crosses the -400 reading, you have about a 1-2 weeks lead-time before the final bottom is reached. And as we all know, the exact bottom is usually very tricky to catch….better to scale-in on the final leg down.

Categories: Stock Market Strategy Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR OCTOBER 16, 2016: The stock market is approaching oversold readings in all of the internal breadth indicators that I monitor. This suggests that a rally is possible next week after further initial weakness in the overall stock market. With the Fear/Greed Sentiment Index within range of an “Extreme Fear” reading, it certainly appears likely that, given additional weakness, a short-to-intermediate term bottom is near. So be ready to commit new funds to the long side if that should happen for a quick ride up to challenge the all-time highs.

STOCK MARKET STRATEGY FOR OCTOBER 16, 2016: The stock market is approaching oversold readings in all of the internal breadth indicators that I monitor. This suggests that a rally is possible next week after further initial weakness in the overall stock market. With the Fear/Greed Sentiment Index within range of an “Extreme Fear” reading, it certainly appears likely that, given additional weakness, a short-to-intermediate term bottom is near. So be ready to commit new funds to the long side if that should happen for a quick ride up to challenge the all-time highs.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal breadth and sentiment indicators suggest that the market is becoming both oversold and under-loved. This could create the conditions for a short-term bottom that will set the stage for a new rally to challenge the all-time highs. If we get weakness on Monday and/or Tuesday, this might be a good time to re-enter the market on the long side.

Categories: Stock Market Strategy Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

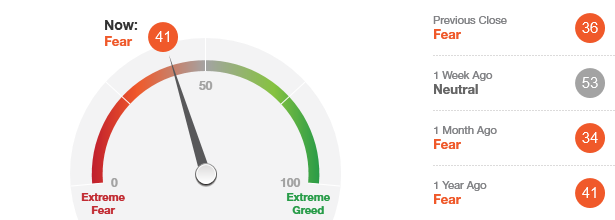

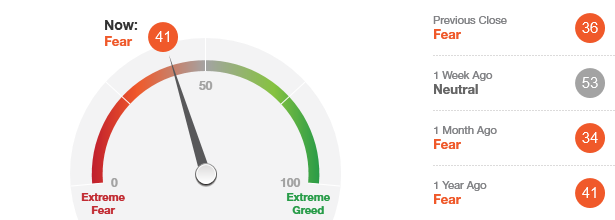

This indicator is labeled as being in the “Fear” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs a little more time in order to generate greater fear. This will help set for a better intermediate-term buying opportunity. That could happen as early as next week. (Source: http://money.cnn.com/data/fear-and-greed)

This indicator is labeled as being in the “Fear” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs a little more time in order to generate greater fear. This will help set for a better intermediate-term buying opportunity. That could happen as early as next week. (Source: http://money.cnn.com/data/fear-and-greed)

Categories: Fear & Greed Index Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

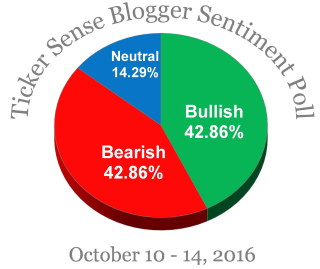

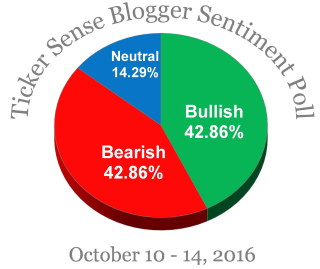

This indicator shows that the general stock market was completely neutral on Monday morning from a sentiment perspective. Both Bullish and Bearish blogger/market analysts weighed in at 42% each. This suggests that the market can go in either direction and that a top or bottom is weeks away. (Source: http://tickersense.typepad.com/ticker_sense/)

Categories: Blogger Sentiment Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR OCTOBER 9, 2016: The stock market continues its slow choppy move sideways to lower. With the uncertainty about the election and interest rates, this should not be too much of a surprise. But I sense that the first move in either direction will be a set up for a reversal around election time. So if the market retreats into early November, expect it to rally afterwards and vice versa. Right now, it looks like a move lower into an oversold condition before the next rally.

STOCK MARKET STRATEGY FOR OCTOBER 9, 2016: The stock market continues its slow choppy move sideways to lower. With the uncertainty about the election and interest rates, this should not be too much of a surprise. But I sense that the first move in either direction will be a set up for a reversal around election time. So if the market retreats into early November, expect it to rally afterwards and vice versa. Right now, it looks like a move lower into an oversold condition before the next rally.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators are trending lower and getting close to the buy range. If the election becomes tighter with a strong hint that Trump may win, then the market may have its “cover story” to go lower into an oversold condition. But most of all, the markets are generally neutral and can go in either direction with about the same degree of certainty. Therefore, it’s a time to do nothing!

Categories: Stock Market Strategy Tags: investing, investments, money, QQQ, retirement, SPY, stock action, stock market, stock trading, stocks, tony robbins, trading, wall street

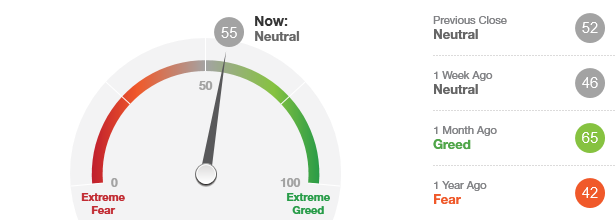

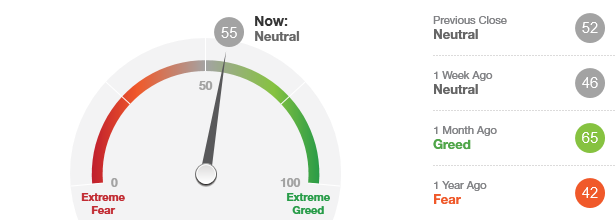

This indicator is labeled as being in the “Neutral” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

This indicator is labeled as being in the “Neutral” zone right now. Ideal buying opportunities have only occurred when the general market has been in the “Extreme Fear” zone. This suggests that the market needs more time and greater fear in order to set itself up for a better intermediate-term buying opportunity. (Source: http://money.cnn.com/data/fear-and-greed)

Categories: Fear & Greed Index Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR OCTOBER 3, 2016: The stock market has been climbing and dropping in the same price range for several weeks now. There isn’t a clear trend and the current market is neutral in terms of overbought vs. oversold. With the national election only a month away, I suspect that the markets will make a clearer trend before and then afterwards. So if we rally into the election, expect the opposite to occur after the election and vice versa. For now, keep your powder dry and wait for a better entry point.

STOCK MARKET STRATEGY FOR OCTOBER 3, 2016: The stock market has been climbing and dropping in the same price range for several weeks now. There isn’t a clear trend and the current market is neutral in terms of overbought vs. oversold. With the national election only a month away, I suspect that the markets will make a clearer trend before and then afterwards. So if we rally into the election, expect the opposite to occur after the election and vice versa. For now, keep your powder dry and wait for a better entry point.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The internal indicators are neutral and trending down slightly. This would suggest that the market is likely to decline over the near term with the chance of reaching an oversold condition shortly. That would set up a rally to challenge and maybe exceed the all-time highs as we approach the elections. But right now isn’t an attractive time to buy unless we can get some more bearishness and lower prices.

Categories: Stock Market Strategy Tags: 401k, annuities, insurance, investing, investing tips, investments, life insurance, money, pension plan, QQQ, retirement, SPY, stock action, stock market, stock trading, stock trading tips, stocks, tony robbins, trading, trading tips, wall street

STOCK MARKET STRATEGY FOR OCTOBER 29, 2016: From a breadth perspective, the stock market is in an oversold condition right now. But it is days to a week or so away from reaching a similar level on a sentiment basis. With the big news on the political front Friday, that sentiment could change quickly to get in line with the breadth indicators causing a bottom to form around Election Day November 7-9. Be ready to buy long on a panic low forming around that time.

STOCK MARKET STRATEGY FOR OCTOBER 29, 2016: From a breadth perspective, the stock market is in an oversold condition right now. But it is days to a week or so away from reaching a similar level on a sentiment basis. With the big news on the political front Friday, that sentiment could change quickly to get in line with the breadth indicators causing a bottom to form around Election Day November 7-9. Be ready to buy long on a panic low forming around that time.