Archive

WALL STREET CRAPS STOCK MARKET STRATEGY – JULY 19, 2015

STOCK MARKET STRATEGY FOR July 19, 2015: The internal market indicators are approaching overbought levels just as the major averages are reaching resistance. While there is still room for more upside action especially with Apple reporting this week, the normal course of action would be a mild or sideways correction. After the recent “Perfect Storm” of negativity (Greece, China, rising interest rates, Wall Street power outage), the market may have created a clearly-defined floor at Dow 17500. This means that all dips should now be bought.

STOCK MARKET STRATEGY FOR July 19, 2015: The internal market indicators are approaching overbought levels just as the major averages are reaching resistance. While there is still room for more upside action especially with Apple reporting this week, the normal course of action would be a mild or sideways correction. After the recent “Perfect Storm” of negativity (Greece, China, rising interest rates, Wall Street power outage), the market may have created a clearly-defined floor at Dow 17500. This means that all dips should now be bought.

Key underlying market indicators show the following:

- NYSE McClellan Oscillator – Ultimate Indicator – 67 (neutral)

- NYSE Overbought/Oversold Indicator – Ultimate Indicator – 65 (neutral)

- Nasdaq McClellan Oscillator – Ultimate Indicator – 68 (neutral)

- Nasdaq Overbought/Oversold Indicator – Ultimate Indicator – 66 (neutral)

- S&P 100 Percent Above 200-Day Moving Average – Ultimate Indicator – 74 (neutral)

- Volatility Indicator – Ultimate Indicator – 79 (Overbought)

***********

ADVICE TO TRADERS AND INVESTORS: Postpone new purchases until the market works off its overbought readings. The next bottom may be short-lived and not amount to much in terms of a price correction. The general market may only need time to stall rather than correct in terms of price. After this most recent “Perfect Storm of Negativity,” the marekt could be in the position of “climbing the wall of worry” in the July-August-September time frame after a brief pause. It terms of sentiment, the market has seen the worst for the time being.

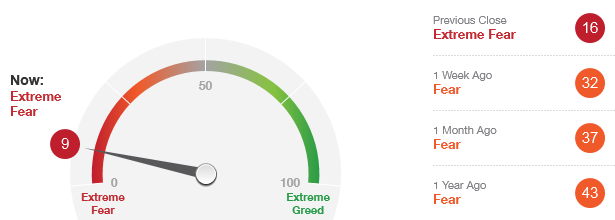

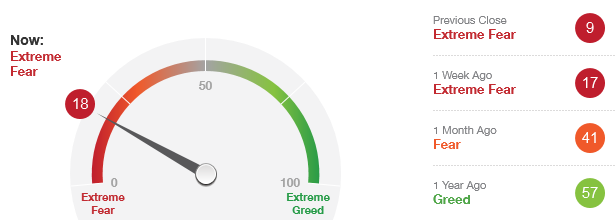

FEAR & GREED INDEX FOR JULY 12, 2015 – Near Buy Zone!

WALL STREET CRAPS STOCK MARKET STRATEGY – JULY 12, 2015

STOCK MARKET STRATEGY FOR July 12, 2015: The stock market’s gap openings on Thursday and Friday made it very difficult to trade last week’s spike bottom. With all oscillators returning to neutral levels, the rhythm of the market is once again set up to retest last week’s lows. If we should get a hard move down on Monday and/or Tuesday, be ready to take new positions as we approach Wednesday (time-wise) or Wednesday’s low readings (price-wise).

STOCK MARKET STRATEGY FOR July 12, 2015: The stock market’s gap openings on Thursday and Friday made it very difficult to trade last week’s spike bottom. With all oscillators returning to neutral levels, the rhythm of the market is once again set up to retest last week’s lows. If we should get a hard move down on Monday and/or Tuesday, be ready to take new positions as we approach Wednesday (time-wise) or Wednesday’s low readings (price-wise).

Key underlying market indicators show the following:

- NYSE McClellan Oscillator – Ultimate Indicator – 63 (neutral)

- NYSE Overbought/Oversold Indicator – Ultimate Indicator – 61 (neutral)

- Nasdaq McClellan Oscillator – Ultimate Indicator – 55 (neutral)

- Nasdaq Overbought/Oversold Indicator – Ultimate Indicator – 55 (neutral)

- S&P 100 Percent Above 200-Day Moving Average – Ultimate Indicator – 53 (neutral)

- Volatility Indicator – Ultimate Indicator – 50 (neutral)

***********

ADVICE TO TRADERS AND INVESTORS: If the market declines hard on Monday and/or Tuesday, be ready to “catch the falling knife” by taking long positions in the market. The bad news “cover story” will most likely come from something related to Greece, China, or an interest rate hike. Whatever the news is it will only serve as an excuse to the market to come down for its retest of the lows.

The safest buy bets will be in the major broad-based Exchange-Traded Funds (DIA, SPY, QQQ) as there is no telling which sectors will perform best. You can also take small positions in the leveraged ETFs (DDM, QLD, SSO) for a quick ride up to challenge the old highs once again.

WALL STREET CRAPS STOCK MARKET STRATEGY – JULY 5, 2015

STOCK MARKET STRATEGY FOR July 5, 2015: The stock market declined sharply last week on the bad news from Greece. This sets up a possible retest of the lows on either Tuesday or Wednesday. If the market should come down hard for the next two sessions, it would be a distinct possibility that a new trade-able low is in place. So be ready to cheer on any bad news and sharp declines early this coming week as an opportunity to go long for a quick ride up to the top of the trading range.

STOCK MARKET STRATEGY FOR July 5, 2015: The stock market declined sharply last week on the bad news from Greece. This sets up a possible retest of the lows on either Tuesday or Wednesday. If the market should come down hard for the next two sessions, it would be a distinct possibility that a new trade-able low is in place. So be ready to cheer on any bad news and sharp declines early this coming week as an opportunity to go long for a quick ride up to the top of the trading range.

Key underlying market indicators show the following:

- NYSE McClellan Oscillator – Ultimate Indicator – 43 (neutral)

- NYSE Overbought/Oversold Indicator – Ultimate Indicator – 42 (neutral)

- Nasdaq McClellan Oscillator – Ultimate Indicator – 31 (neutral)

- Nasdaq Overbought/Oversold Indicator – Ultimate Indicator – 33 (neutral)

- S&P 100 Percent Above 200-Day Moving Average – Ultimate Indicator – 35 (neutral)

- Volatility Indicator – Ultimate Indicator – 30 (neutral)

***********

ADVICE TO TRADERS AND INVESTORS: If the market declines early next week (Tuesday or Wednesday), we should be prepared to “catch the falling knife” with gradual buying on the way down. This would qualify as a “5-Day Retest” of a previous market low. The market doesn’t even have to be near the previous lows in terms of price levels. It only has to drop hard for two days in a row. The safest bets will be in the major broad-based Exchange-Traded Funds (DIA, SPY, QQQ) as there is no telling which sectors will perform best. You can also take small positions in the leveraged ETFs (DDM, QLD, SSO) for a quick ride up to challenge the old highs once again.