STOCK MARKET STRATEGY FOR DECEMBER 1, 2018: The stock market has gone straight up since its bottom on Black Friday. That day was marked by a new closing low that was not confirmed by the majority of breadth and momentum indicators. This is a classic “Granville Buy Signal” named for the infamous stock market analyst of the period from 1977 to 1983. From this point forward, after the strongest one week rally in stock market history, one could expect that the market to continue going higher in a zig-zag pattern until the end of the year. If you missed this last opportunity, you’ll have to buy on any short-term oversold conditions.

STOCK MARKET STRATEGY FOR DECEMBER 1, 2018: The stock market has gone straight up since its bottom on Black Friday. That day was marked by a new closing low that was not confirmed by the majority of breadth and momentum indicators. This is a classic “Granville Buy Signal” named for the infamous stock market analyst of the period from 1977 to 1983. From this point forward, after the strongest one week rally in stock market history, one could expect that the market to continue going higher in a zig-zag pattern until the end of the year. If you missed this last opportunity, you’ll have to buy on any short-term oversold conditions.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 22 or “Extreme Fear.” It should be in the “neutral” zone shortly with the continued rally in the stock market. Use any short-term oversold readings as a place to add to long positions through the end of the year. It looks like a “Santa Claus Rally” is in the cards for this year.

STOCK MARKET STRATEGY FOR NOVEMBER 18, 2018: The stock market appears to be in the process of retesting its October bottom. For now, it’s filled the upside gaps on its most recent move down. That means that a rally could possibly start from this area right now. Or it could begin down again, reach oversold conditions, and successfully test the October bottom. That kind of process would probably take place on the week following Thanksgiving.

STOCK MARKET STRATEGY FOR NOVEMBER 18, 2018: The stock market appears to be in the process of retesting its October bottom. For now, it’s filled the upside gaps on its most recent move down. That means that a rally could possibly start from this area right now. Or it could begin down again, reach oversold conditions, and successfully test the October bottom. That kind of process would probably take place on the week following Thanksgiving.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 10 or “Extreme Fear.” It has been in this range for nearly a month and has shifted the sentiment to the negative. That means that a rally starting from this area could last several weeks or months. But the current short-term climate makes me think that catching the absolute bottom will be tricky as always. And a smart, well thought out betting strategy will be important in order to take positions without risk missing the opportunity. This requires that a trader pays close attention over the next two weeks.

STOCK MARKET STRATEGY FOR NOVEMBER 10, 2018: The stock market made a huge upside move in response to the election results on Wednesday. The question is whether that move signified a breakout to a new highs or a last grasp top for the latest bounce. Since this is anyone’s guess, the next entry point would likely be an oversold condition in the majority of breadth indicators. But a strong move down from here and a resumption of October’s down move would certainly change the character of the market again. This is a time for caution, as well as a time for opportunity for those willing to accept the risks and stomach the volatility.

STOCK MARKET STRATEGY FOR NOVEMBER 10, 2018: The stock market made a huge upside move in response to the election results on Wednesday. The question is whether that move signified a breakout to a new highs or a last grasp top for the latest bounce. Since this is anyone’s guess, the next entry point would likely be an oversold condition in the majority of breadth indicators. But a strong move down from here and a resumption of October’s down move would certainly change the character of the market again. This is a time for caution, as well as a time for opportunity for those willing to accept the risks and stomach the volatility.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 18 or “Extreme Fear.” While this is still in the “Extreme Fear” category, it is far off of the lows from the previous two weeks. This might suggest that the market is simply retracing its strong move up with a chance of forming another pivot bottom in about 5-10 trading days. So be alert and ready to act on a brief buying opportunity ahead.

STOCK MARKET STRATEGY FOR NOVEMBER 3, 2018: The stock market had a key reversal on Monday that carried over all the way until Friday morning. In the process, it has recovered much of its losses over the month. Right now, several of the breadth indicators have short-term overbought readings suggesting that a retest of the previous lows could be in the making. If we are to assume that the bull market is only in a correction mode, then it would make sense to take positions on weakness as it nears last Monday’s previous lows. If that retest comes on light volume, then a reversal to the upside is even more likely.

STOCK MARKET STRATEGY FOR NOVEMBER 3, 2018: The stock market had a key reversal on Monday that carried over all the way until Friday morning. In the process, it has recovered much of its losses over the month. Right now, several of the breadth indicators have short-term overbought readings suggesting that a retest of the previous lows could be in the making. If we are to assume that the bull market is only in a correction mode, then it would make sense to take positions on weakness as it nears last Monday’s previous lows. If that retest comes on light volume, then a reversal to the upside is even more likely.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 7 or “Extreme Fear.” This reading suggests that there is plenty of room for the market to rally. This time of year can be particularly tricky, but present several trading opportunities. But not everyone is suited for playing this much volatility and I happen to fall into that category. But a light volume retest of the previous lows would present a lower-risk entry point for the next ride up. But you never know about this market. It may just continue to go straight up from here.

STOCK MARKET STRATEGY FOR OCTOBER 21, 2018: The stock market has either completed its bounce or is in the process of retesting the previous lows. I have a hunch that whichever direction the market goes on Monday, the rest of the week will do the opposite. So if we get a rally on Monday, I’d be selling into that strength, but conversely I’d be buying on a retest of the lows. Of course this is a gamble, but something that I see as an opportunity for gain.

STOCK MARKET STRATEGY FOR OCTOBER 21, 2018: The stock market has either completed its bounce or is in the process of retesting the previous lows. I have a hunch that whichever direction the market goes on Monday, the rest of the week will do the opposite. So if we get a rally on Monday, I’d be selling into that strength, but conversely I’d be buying on a retest of the lows. Of course this is a gamble, but something that I see as an opportunity for gain.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 14 or “Extreme Fear.” It has been in the this area for over a week and usually doesn’t stay here for more than two weeks. So the market is either going to rally here or is in the middle point of a decline into a lower-risk buying zone before the election.

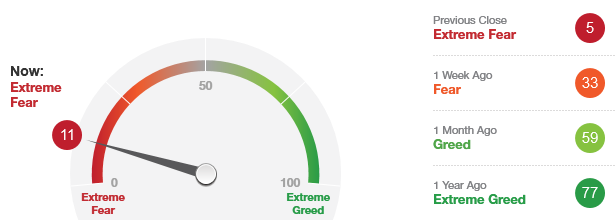

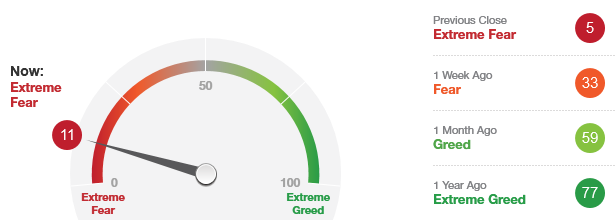

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” has a current reading of 11 after reaching an even more extreme reading of 5 on Friday. This suggests that the market is within the buying opportunity area.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” has a current reading of 11 after reaching an even more extreme reading of 5 on Friday. This suggests that the market is within the buying opportunity area.

This indicator has gone down enough but only may need to spend more time in this area before rallying upwards in the coming weeks.

With the internal indicators in “oversold” readings, this suggests that a tradable bottom could occur in this time period – which is within the next two weeks. However, there is always the possibility of one more crash down of obvious “bad news” in order to shake out the weak hands.

STOCK MARKET STRATEGY FOR SEPTEMBER 30, 2018: The stock market is churning at a high consolidation area which neither good or bad. While it may seem like the market is overdue for a correction after this long rally, it still shows resiliency in the face of a mixed bag of political and economic news. With the three timing indicators set almost identically around the neutral reading of “50,” I’d expect the market to either correct into a short-term bottom or rally into resistance and a short-term top. But most of all, there is nothing to do right now.

STOCK MARKET STRATEGY FOR SEPTEMBER 30, 2018: The stock market is churning at a high consolidation area which neither good or bad. While it may seem like the market is overdue for a correction after this long rally, it still shows resiliency in the face of a mixed bag of political and economic news. With the three timing indicators set almost identically around the neutral reading of “50,” I’d expect the market to either correct into a short-term bottom or rally into resistance and a short-term top. But most of all, there is nothing to do right now.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 47 or “Neutral.” This makes the market within striking range of a quick move to “Extreme Fear” under 25 and a chance to a short-term tradable rally to participate in.

STOCK MARKET STRATEGY FOR SEPTEMBER 23, 2018: The market’s rally has continued to push upwards while running into resistance. The current breadth indicators are presently in mid-range (neutral) and suggests that another challenge to new All-Time Highs is likely in the near term. If we should get an “oversold” condition in the coming weeks, it would be worth the risk to trade for another leg of the rally despite the time and extent of this bull run.

STOCK MARKET STRATEGY FOR SEPTEMBER 23, 2018: The market’s rally has continued to push upwards while running into resistance. The current breadth indicators are presently in mid-range (neutral) and suggests that another challenge to new All-Time Highs is likely in the near term. If we should get an “oversold” condition in the coming weeks, it would be worth the risk to trade for another leg of the rally despite the time and extent of this bull run.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 75 or “Extreme Greed.” This doesn’t mean that the market is overbought and time to sell. But it does suggest that it is not the time to buy. That would come on a move to the “Extreme Fear” territory.

STOCK MARKET STRATEGY FOR JULY 31, 2018: The market has dropped quickly into a semi-oversold condition. This would suggest that a bounce could occur in the next day or two. But after the bounce should come another wave down into a better buying opportunity. Be ready in case the market presents the right conditions for a tradable rally at the end of this week or the beginning to next week.

STOCK MARKET STRATEGY FOR JULY 31, 2018: The market has dropped quickly into a semi-oversold condition. This would suggest that a bounce could occur in the next day or two. But after the bounce should come another wave down into a better buying opportunity. Be ready in case the market presents the right conditions for a tradable rally at the end of this week or the beginning to next week.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading 64 or “Greed.” I’m still awaiting for a quick move into the “Extremely Fear” area in order to feel like the conditions are ripe for a more sustainable rally. So, we continue to wait for a better trading opportunity to the upside.

STOCK MARKET STRATEGY FOR JULY 23, 2018: The stock market has been hovering in a trading range for several weeks now. This choppy action presents only short-term trading opportunities. But rallies from oversold conditions have been producing profitable moves for nimble traders. With that in mind, I have selected what I consider as the four more reliable technical indicators when used together for short-term trading. This change is designed to make decisions easier to make with the understanding that only small & short-term trading positions are being maintained.

STOCK MARKET STRATEGY FOR JULY 23, 2018: The stock market has been hovering in a trading range for several weeks now. This choppy action presents only short-term trading opportunities. But rallies from oversold conditions have been producing profitable moves for nimble traders. With that in mind, I have selected what I consider as the four more reliable technical indicators when used together for short-term trading. This change is designed to make decisions easier to make with the understanding that only small & short-term trading positions are being maintained.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The market appears to be at a short-term top and it is time to step aside for now. Another short-term upside set-up will take at least another week to develop.

STOCK MARKET STRATEGY FOR DECEMBER 1, 2018: The stock market has gone straight up since its bottom on Black Friday. That day was marked by a new closing low that was not confirmed by the majority of breadth and momentum indicators. This is a classic “Granville Buy Signal” named for the infamous stock market analyst of the period from 1977 to 1983. From this point forward, after the strongest one week rally in stock market history, one could expect that the market to continue going higher in a zig-zag pattern until the end of the year. If you missed this last opportunity, you’ll have to buy on any short-term oversold conditions.

STOCK MARKET STRATEGY FOR DECEMBER 1, 2018: The stock market has gone straight up since its bottom on Black Friday. That day was marked by a new closing low that was not confirmed by the majority of breadth and momentum indicators. This is a classic “Granville Buy Signal” named for the infamous stock market analyst of the period from 1977 to 1983. From this point forward, after the strongest one week rally in stock market history, one could expect that the market to continue going higher in a zig-zag pattern until the end of the year. If you missed this last opportunity, you’ll have to buy on any short-term oversold conditions.