The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading is in the “Extreme Greed” range at 81. This indicator is now suggesting that the general stock market is in the danger zone. This means that it’s not the time to buy in order to go long equities. Instead, it’s a probably best to lightened up on extended positions and reduce your risk.

And while the market may correct, bottom, and return to this same price level, it’s usually prudent to begin taking your gains especially when the sentiment is overextended like it is now. When the technicals and the sentiment confirm each other, it’s smart to anticipate an immediate trend change. That doesn’t necessarily mean going short because that in itself is a whole different game to play for most.

Note: A chapter in my book, Wall Street Craps: How to Play Today’s Hot & Cold Stock Market for Fast Money With Less Risk, deals with the unexpected unique challenges of playing the short vs. the traditional long game of stock market investing & the dangers of leveraged short Exchange-Traded Funds.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading is in the “Greed” range at 64. This indicator leaves room for the market to rally further until it reaches unsafe territory in the “Extreme Greed” area.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading is in the “Greed” range at 64. This indicator leaves room for the market to rally further until it reaches unsafe territory in the “Extreme Greed” area.

A few weeks ago, this indicator gave a one-day reading of 25 in the “Extreme Fear” range. That proved to be the bottom in retrospect as this bull market continues to power through. With that in mind, it’s probably wise to avoid any short positions and await the next oversold reading in the breadth oscillators or an “Extreme Fear” reading below 26 in the Fear/Greed Sentiment Index in order to take additional long positions.

But at this point, taking profits would not be such an unwise thing to do in anticipation of the next sharp downdraft with seems likely to occur after an “obvious” piece of good public news (like the passing of the new health act).

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

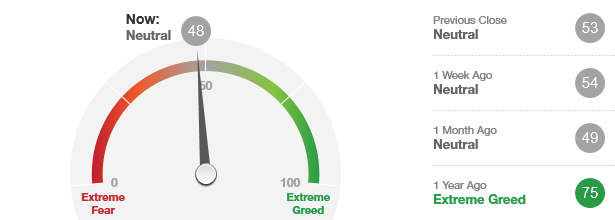

STOCK MARKET STRATEGY FOR JUNE 18, 2017: The stock market is in a neutral position with an equal probability of going either up or down. Expect the market to set itself up for its next big move by creating a false small move in one direction or the other – followed by a stronger move in the opposite direction. If I had to guess, the market will probably decline throughout the week – setting up a larger rally to follow. All we need is the market to show some “oversold” readings in order to act.

STOCK MARKET STRATEGY FOR JUNE 18, 2017: The stock market is in a neutral position with an equal probability of going either up or down. Expect the market to set itself up for its next big move by creating a false small move in one direction or the other – followed by a stronger move in the opposite direction. If I had to guess, the market will probably decline throughout the week – setting up a larger rally to follow. All we need is the market to show some “oversold” readings in order to act.

Key underlying short-term timing indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “neutral” suggesting a balance between bullish and bearish sentiment. If we should get “oversold” readings in a few of the internal indicators or an “Extreme Fear” reading in the Fear/Greed Index, we could be setting up a chance to “buy the dip” for another ride up to higher highs.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

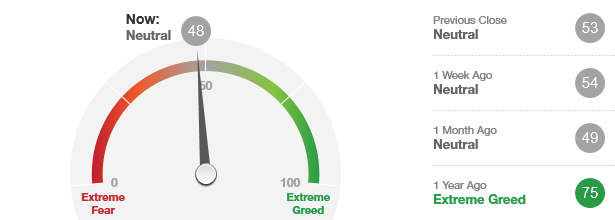

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading is in the neutral range today despite being at the higher part of the trading range. This could have multiple interpretations. For me, I see this as a potential buy signal after a relatively short period of price weakness. That weakness could translate into “Extreme Fear” in this indicator without too much damage to the present price structure. If we should get a reading in the “Extreme Fear” area accompanied by “oversold” reading in many breadth indicators, we could find another “dip” to ride the market up for another spectacular rally. Until proven otherwise, continue to look at “oversold” and “under-loved” conditions as opportunities to buy.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading is in the neutral range today despite being at the higher part of the trading range. This could have multiple interpretations. For me, I see this as a potential buy signal after a relatively short period of price weakness. That weakness could translate into “Extreme Fear” in this indicator without too much damage to the present price structure. If we should get a reading in the “Extreme Fear” area accompanied by “oversold” reading in many breadth indicators, we could find another “dip” to ride the market up for another spectacular rally. Until proven otherwise, continue to look at “oversold” and “under-loved” conditions as opportunities to buy.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR APRIL 23, 2017: The stock market remains in a neutral position with the ability to go in either direction. The last two weeks has presented the market with an opportunity to become “oversold” but rallied modestly instead to prevent investors and traders from getting to a low-risk entry point. Expect the market to set itself up for the next trading opportunity in the coming weeks, but right now it’s best to take a wait and see approach to this tricky news-driven market.

STOCK MARKET STRATEGY FOR APRIL 23, 2017: The stock market remains in a neutral position with the ability to go in either direction. The last two weeks has presented the market with an opportunity to become “oversold” but rallied modestly instead to prevent investors and traders from getting to a low-risk entry point. Expect the market to set itself up for the next trading opportunity in the coming weeks, but right now it’s best to take a wait and see approach to this tricky news-driven market.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Fear” after being in the “Extreme Fear” range for only one trading day. I would expect a much deeper reading in the “Extreme Fear” range in order to safely say that the stock market is “oversold” or “under-loved” in terms of sentiment. The current geopolitical climate should serve to push sentiment strongly in one direction or the other. And most likely, it will create the desire emotion of “extreme fear” which allows presents disciplined traders with a low-risk buying opportunity. So right now it’s best to let the market set itself up for the next trading opportunity.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

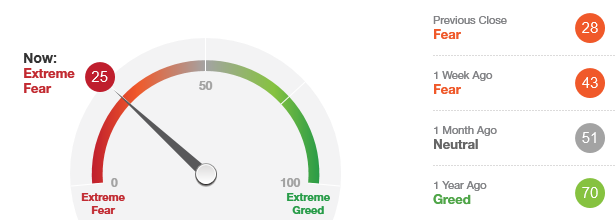

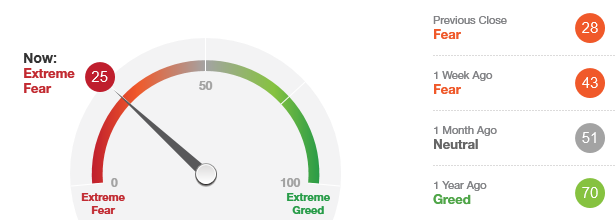

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has finally moved into the “Extreme Fear” range this past week. But it is just touching that area and I would expect a reading under 20 in order to feel like it is truly registering “Extreme Fear.”

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has finally moved into the “Extreme Fear” range this past week. But it is just touching that area and I would expect a reading under 20 in order to feel like it is truly registering “Extreme Fear.”

But this indicator is now saying that it’s time to start thinking about accumulating pilot positions for the next rally. The challenge is that there hasn’t been much price erosion in the market since its March top. Hence, many positions are still well over their 200-day moving averages with plenty more room to correct.

I’d look at this indicator as simply a sign to start thinking about going long the general market and use other breadth indicators to fine-tune the timing. And many of the breadth indicator are starting to flash buy alerts as well. So a bottom is close at hand unless we rally quickly to lessen the downward pressure.

Categories: Fear & Greed Index Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR APRIL 8, 2017: The stock market remains in neutral territory despite the unstable news background. But the news will help create the cover story for the next top or bottom as it will polarize public sentiment. Right now it appears that the breadth oscillators are heading down towards an oversold bottom in the near term (3 to 5 days). If the readings become low enough, a rally worth trading to the upside may be in store for us. But until those low reading occur, it’s probably wisest to keep your powder dry for better odds in playing this tricky market.

STOCK MARKET STRATEGY FOR APRIL 8, 2017: The stock market remains in neutral territory despite the unstable news background. But the news will help create the cover story for the next top or bottom as it will polarize public sentiment. Right now it appears that the breadth oscillators are heading down towards an oversold bottom in the near term (3 to 5 days). If the readings become low enough, a rally worth trading to the upside may be in store for us. But until those low reading occur, it’s probably wisest to keep your powder dry for better odds in playing this tricky market.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Fear” after being in the “Neutral” area for a week. The set-up in the breadth oscillators suggests that a short-term bottom is nearby. If the Fear/Greed Sentiment Index can register an “Extreme Fear” reading in the meantime, we may have a sharp rally to ride into May. But until that sets up properly, it’s best to do nothing except get your ducks in a row.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

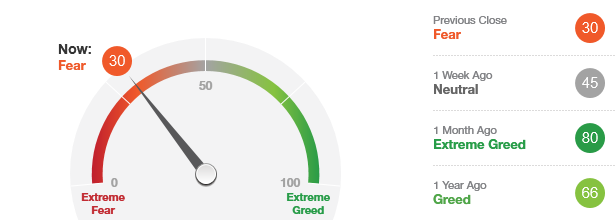

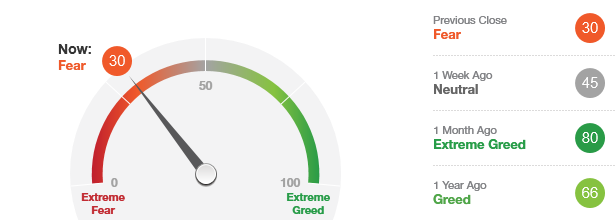

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has moved into the “Fear” range this past week. When it reaches the “Extreme Fear” area, it will become one of the pre-conditions for an intermediate-term stock market bottom.

The “Fear/Greed Sentiment Index: What Emotion is Driving the Market Now?” reading has moved into the “Fear” range this past week. When it reaches the “Extreme Fear” area, it will become one of the pre-conditions for an intermediate-term stock market bottom.

So any further weakness in the general market will probably put this index in the “Extreme Fear” range which means that it’s a time to start getting your feet wet with a diversified long position. My favorite plays would be the SPY and QQQ Exchange-Trade Funds.

But since the last market top was not very far from the current position, I’d look at this next bottom as being only a starting point to challenge the old highs.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR MARCH 19, 2017: The stock market is currently continuing its “bounce” off of a short-term oversold condition. This bounce has not been very strong and is approaching the “overbought” range. This suggests that the buying is not very strong and another round of declines will resume shortly. A better buying opportunity will likely present itself in the future, but when that will be depends on how oversold the market can become. In my opinion, this is a good time to be out of the market.

STOCK MARKET STRATEGY FOR MARCH 19, 2017: The stock market is currently continuing its “bounce” off of a short-term oversold condition. This bounce has not been very strong and is approaching the “overbought” range. This suggests that the buying is not very strong and another round of declines will resume shortly. A better buying opportunity will likely present itself in the future, but when that will be depends on how oversold the market can become. In my opinion, this is a good time to be out of the market.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Neutral” after being in the “Greed” and “Extreme Greed” for several weeks. If it can continue to weaken into the “Extreme Fear” range, we could be in store for a good intermediate term bottom in which to buy into. But right now, it’s still anyone’s guess which direction we go and for how long. But at least, we are getting a correction from the rally that left most investors behind.

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street

STOCK MARKET STRATEGY FOR MARCH 5, 2017: The stock market blasted to a new high on its new leg up after President Trump’s State of the Union address. The relentless rally continues with a possible pause next week followed by another quick rally to retest this week’s highs. What is surprising is how close the internal indicators are to being “oversold.” This could mean that a short-term buy signal is not far away and this seems to make almost no sense at all. I’d be looking at the Volatility Indicator for the best timing tool for this next bottom.

STOCK MARKET STRATEGY FOR MARCH 5, 2017: The stock market blasted to a new high on its new leg up after President Trump’s State of the Union address. The relentless rally continues with a possible pause next week followed by another quick rally to retest this week’s highs. What is surprising is how close the internal indicators are to being “oversold.” This could mean that a short-term buy signal is not far away and this seems to make almost no sense at all. I’d be looking at the Volatility Indicator for the best timing tool for this next bottom.

Key underlying short-term market indicators show the following:

***********

THE BOTTOM LINE: The Fear/Greed Index is currently reading “Greed” after being in the “Extreme Greed” for a few days last week. This doesn’t mean that the market is going to go down. It just suggests that you shouldn’t be buying at this time. This type of strong upside market is not one that you’d want to play the short side on. Instead, look for short-term oversold conditions to pop up that offer you a good chance to make some fast money with less risk. Don’t be too surprised if this market continues to climb the proverbial “wall of worry.”

Categories: Stock Market Strategy Tags: insurance, investing, investments, money, retirement, stock market, stock market timing, stock trading, stocks, tony robbins, trading, wall street